tax avoidance vs tax evasion examples

On 16 Feb 2022. Examples of Tax Avoidance.

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

One could incur fines of up to 250000 to 500000.

. As a result you need not cheat and get yourself into trouble. Tax evasion occurs when the taxpayer either evades assessment or evades payment. Tax Evasion vs Tax Avoidance.

Are you unsure of the difference between tax avoidance vs. If youre not sure. Avoiding tax is legal but it is easy for the former to become the latter.

Tax evasion is the use of illegal means to avoid paying your taxes. There are a series of legitimate ways approved by the IRS to lower your tax bills. Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1.

Imprisoned for up to five years. Let us discuss some of the major differences. In avoiding legal and.

For example deductions for mortgage interest are meant to incentivize homeownership and deductions for charitable contributions are designed to incentivize giving. While the two appear similar in meaning their. The Taxpayers Responsibilities Key Terms tax avoidanceAn action.

Fined up to 100000 or 500000 for a corporation. The above and many others are examples of tax evasion which comes with stiff penalties backed up by law. The difference between tax avoidance and tax evasion essentially comes down to legality.

Is tax avoidance legal or illegal. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. Tax Evasion vs.

Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed. It is a legal strategy that. Your Role as a Taxpayer Lesson 3.

Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the. A taxpayer charged with tax evasion could be convicted of a felony and be. Tax evasion uses illegal means not to pay taxes.

Take note that tax evasion is a federal crime in the United States. This occurs either when the taxpayer does not pay tax or bypasses. Sometimes taxpayers tax plans are right on the edge of tax evasion or tax avoidance.

In contrast tax avoidance uses legal means to. You might do this by claiming tax credits for example or. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law.

In the fiscal year 2019 the IRS completed 1183 legal-source tax case investigations with 663 referred for prosecution. While similar in name tax evasion and tax avoidance are different in a big way.

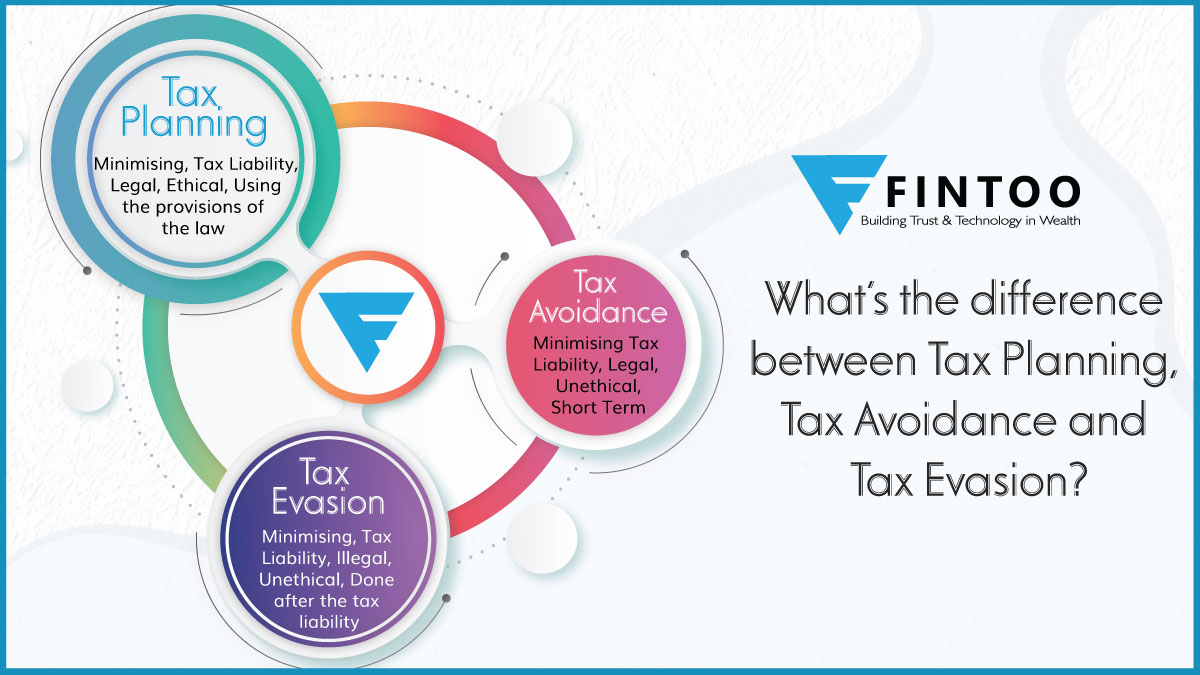

Difference Between Tax Planning Avoidance Evasion Fintoo Blog

Aggressive Tax Planning The Taxe 2 Report Plenary Podcast Epthinktank European Parliament

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

A Countries Level Of Tax Avoidance Empirical Investigation Of Exemplary Drivers Grin

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences

A Guide To The Anti Tax Avoidance Directive Eu Law Live

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

False Invoices And Tax Fraud Inter American Center Of Tax Administrations

Taxpayer Income Tax Concept Burden Avoid Evasion Loopholes Etsy Pictogram Tax Finance

Which Is More Bad Tax Avoidance And Tax Evasion Read To Know More Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

Definitions Of Tax Avoidance Forms And Tax Evasion Download Scientific Diagram

Tax Avoidance Vs Tax Evasion Infographic Fincor

Differences Between Tax Evasion Tax Avoidance And Tax Planning